The Technological Transition to Tokenization in the Trillion-Dollar Real Estate Market

A pivotal shift impacting verticals within the real estate ecosystem

KEY HIGHLIGHTS

IMPACT ACROSS REAL ESTATE FINANCE VERTICALS

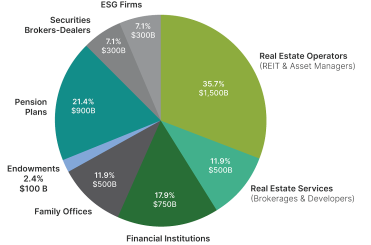

Potential Tokenization Impact Across Key Real Estate Verticals ($B)

Real Estate Operators (REITs and Private Equity Real Estate Asset Managers):

The top 30 investment firms manage over $10 trillion, with some managers allocating 5% to 25% to real estate, indicating investments between $500 billion and $2.5 trillion.

Real Estate Services (Brokerages and Developers)

Brokerage Services: Tokenization could cut transaction times and costs by up to 30%,

potentially saving the industry billions annually.

Developers: Developers can increase funding sources by 25% through tokenization, expediting

project completion rates

Financial Institutions

Institutions could unlock upwards of $750 billion in new trading opportunities by increasing asset liquidity through tokenization

Family Offices

With $1.516 trillion in real estate investments, tokenization could enhance asset liquidity, aligning investment practices with generational shifts towards liquidity and flexibility.

Endowments

Tokenization can enhance the liquidity of over $100 billion in real estate investments, potentially increasing returns by up to $20 billion annually for major endowments globally

Pension Plans

With pension funds allocating between 5% to 15% of their $9 trillion portfolios to real estate, the amount invested could range from approximately $500 billion to $1.35 trillion,representing a

signifi cant portion of potential real estate assets to be impacted

Securities Broker-Dealers

Embracing tokenization could help broker-dealers capture up to 15% of the growing real estate digital securities brokerage market, translating to an additional revenue opportunity of around $100 billion over the next decade

ESG Firms

With tokenization, ESG firms can tap into $300 billion worth of potential market

value in tokenized real estate & infrastructure assets, enhancing investment transparency

and aligning with global sustainability goals

Secure Your Exclusive Copy

Complete the form to receive this institutional-grade market analysis directly to your inbox.

Click the button below to download the report

Securities are offered through RedSwan Markets, LLC, (“RedSwan Markets”) a registered broker-dealer and member FINRA/SIPC and a wholly owned subsidiary of RedSwan PC, Inc, an SEC Registered Investment Advisor. Check the background of RedSwan Markets on FINRA BrokerCheck. View our Form CRS.

RedSwan Markets may provide recommendations, at times, but does not provide investment advice nor ongoing advice or monitoring of your investments. No communication through herein or in any other medium should be construed as such. Securities offered on the RedSwan Markets website have not been registered under the Securities Act of 1933 and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements. Assets listed herein, such as digital security tokens using blockchain, are speculative, involve a high degree of risk, are generally illiquid, may have no value, have limited regulatory certainty, are subject to potential market manipulation risks and may expose investors to loss of principal. Investments in private placements are also speculative and involve a high degree of risk. Investors must be able to afford the loss of their entire investment. Eligibility to buy and sell securities on the RedSwan Markets website is determined by RedSwan Markets in its sole discretion. Offers to sell, or the solicitations of offers to buy any security can only be made through official offering documents that contain important information about risks, fees and expenses associated with the applicable securities available for sale. Investors should conduct their own due diligence, not rely on the financial assumptions or estimates displayed herein, and are encouraged to consult with a financial advisor, attorney, accountant, tax advisors, and any other professional that can help you to understand and assess the risks associated with any investment opportunity. Past performance is not indicative of future results. Neither the Securities and Exchange Commission nor any federal or state securities commission or regulatory authority has recommended or approved any investment or the accuracy or completeness of any of the information or materials provided herein or through any references/links herein. Further, there can be no assurance that any valuations provided by issuers are accurate or in agreement with market or industry valuations. RedSwan Markets and its affiliates make no representations or warranties as to the accuracy of such information. RedSwan Markets may collect certain information about you that helps us comply with various securities regulations and rules and the USA PATRIOT Act, a Federal law that requires all securities firms to obtain, verify, and record information that identifies each applicant. The information also helps us more fully understand your investment profile and identify what types of investments or strategies may be suitable for you.